Quantitative Finance

Modern Portfolio Theory has become pervasive due to its effectiveness, simplicity and formal foundation. However, with time, its assumptions have become less valid and its primary purpose, risk reduction, has become more difficult to acheive. Our goal here is to determine if one can make a slight change to the theory and still acheive:

- Asset growth over the long term.

- Risk reduction, with as few negative results over time as possible.

- A tractable formalism with the same intellectual rigor as Modern Portfolio Theory, while still permitting easy calculation.

is the average return of a portfolio component.

is the average return of a portfolio component. is the portfolio component's drift.

is the portfolio component's drift.  is the portfolio component's linear systematic risk.

is the portfolio component's linear systematic risk. is the average return of the market.

is the average return of the market. is the portfolio component's error term.

is the portfolio component's error term.

is the portfolio component's positive linear systematic risk.

is the portfolio component's positive linear systematic risk. is the probability of a rising market.

is the probability of a rising market. is the average of the market's positive price changes.

is the average of the market's positive price changes. is the portfolio component's negative linear systematic risk.

is the portfolio component's negative linear systematic risk. is the probability of a falling market.

is the probability of a falling market. is the average of the market's negative price changes.

is the average of the market's negative price changes.

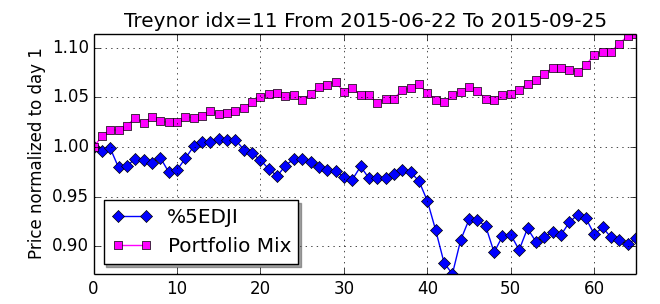

Demonstration of the multifactor model during the August-September 2015 correction

However, the standard questions plaguing all portfolio modeling approaches still remain:

- What "training period" length should be used to calculate the above parameters?"

- What is the portfolio component selection method?

- What ranking method should be used to select the components with the appropriately high and low alphas?

- How many components should go into a portfolio?

- What is the best method to calculate p and q?

- What is the holding period length? (test period)

- How should one model corporate actions? (e.g. Corporate actions, dividend distributions, management, investments, merchantability, etc.)

- How is the expected Rate of Return estimated?