20170324reproducePortfolioVisualizer AAII-SV-CIMI/20170324reproducePortfolioVisualizer/

- Was able to duplicate www.portfoliovisualizer.com's results in pandas with the patient help of Tuomo Lampinen:

o Notes

- portfoliovisualizer does monthly compounding not lastMonthPrice/firstMonthPrice

- portfoliovisualizer Treasury rates are based on Farma French measurements

(assuming I made no error) this is the most interesting result.

It shows that the Farma French Data used in the calculation of Dual Momentum in portfoliovisualizer is smoothed and has a 6 month lag.

o 'dirty' data: yahoo quote data significantly threw off the calculation

o Precision: 2/200 calculations were close enough for roundoff error to affect it.

o 'better' data sources for the Treasury rate.

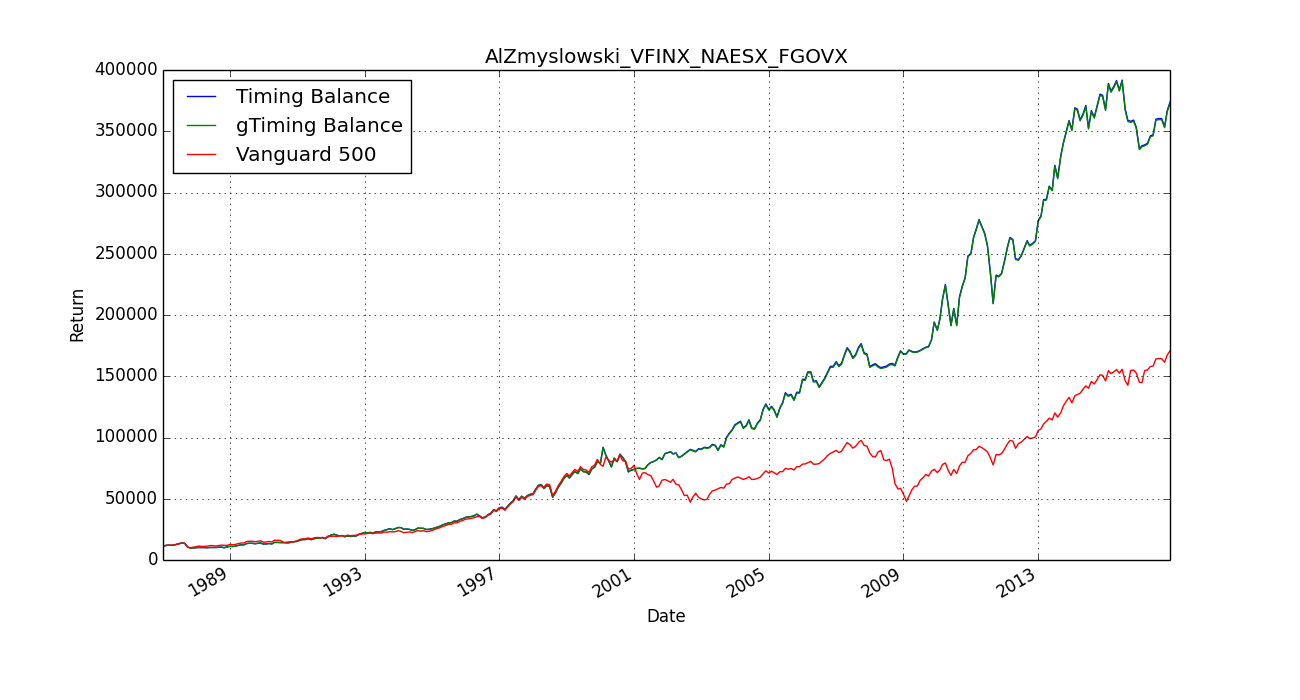

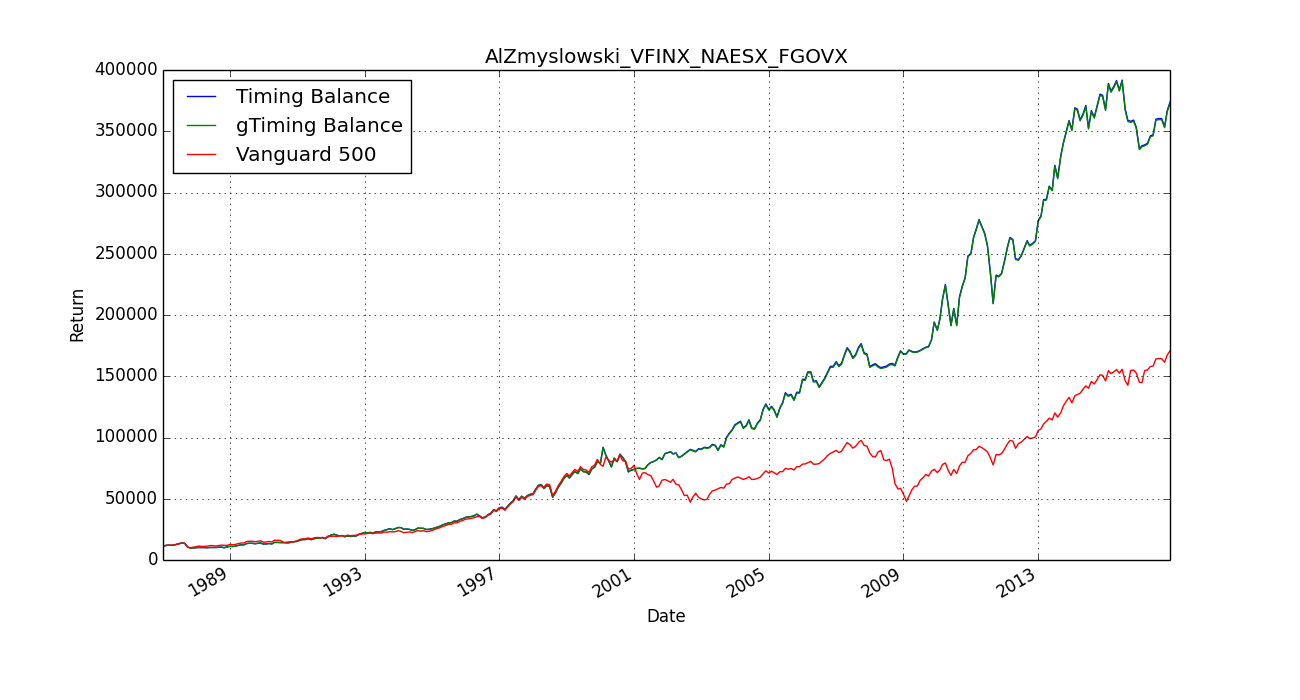

Al used:

o VFINX (Vanguard 500 Index Fund Investor Class) and

o NAESX (Vanguard Small Capitalization Index Fund Investor Shares) as the Equity list and

o FGOVX (Fidelity® Government Income Fund) as the “Out of Market Asset”.

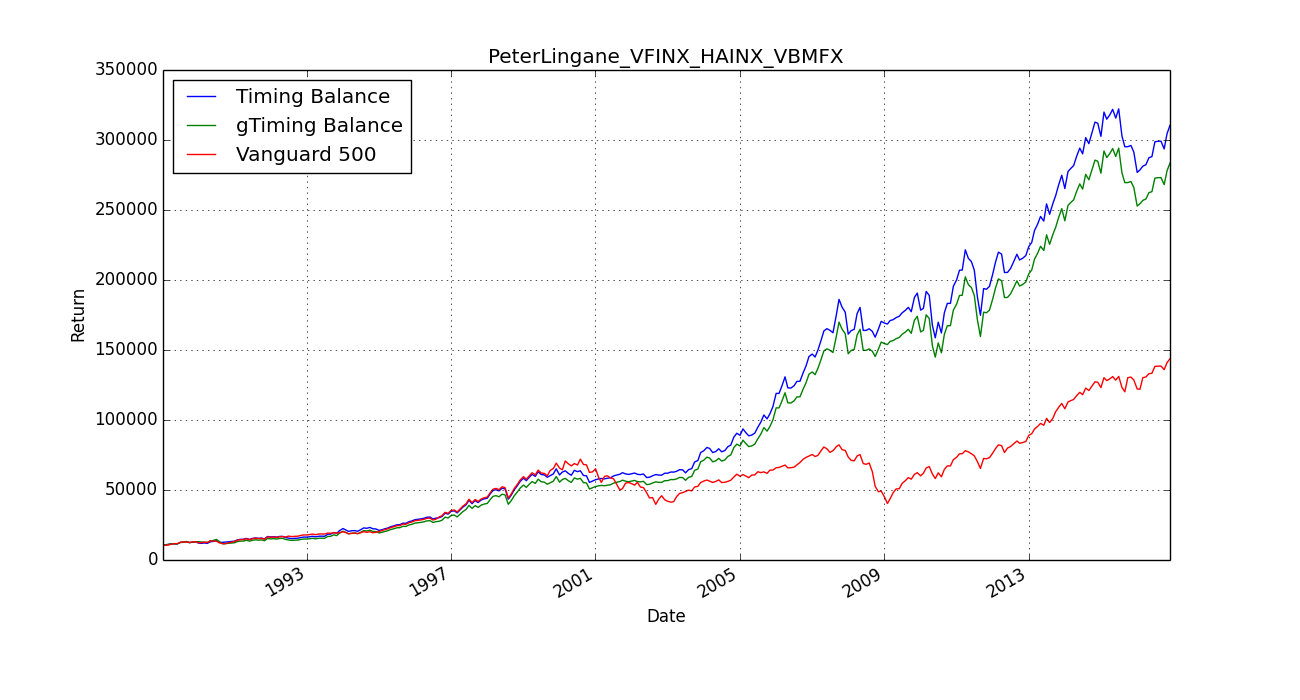

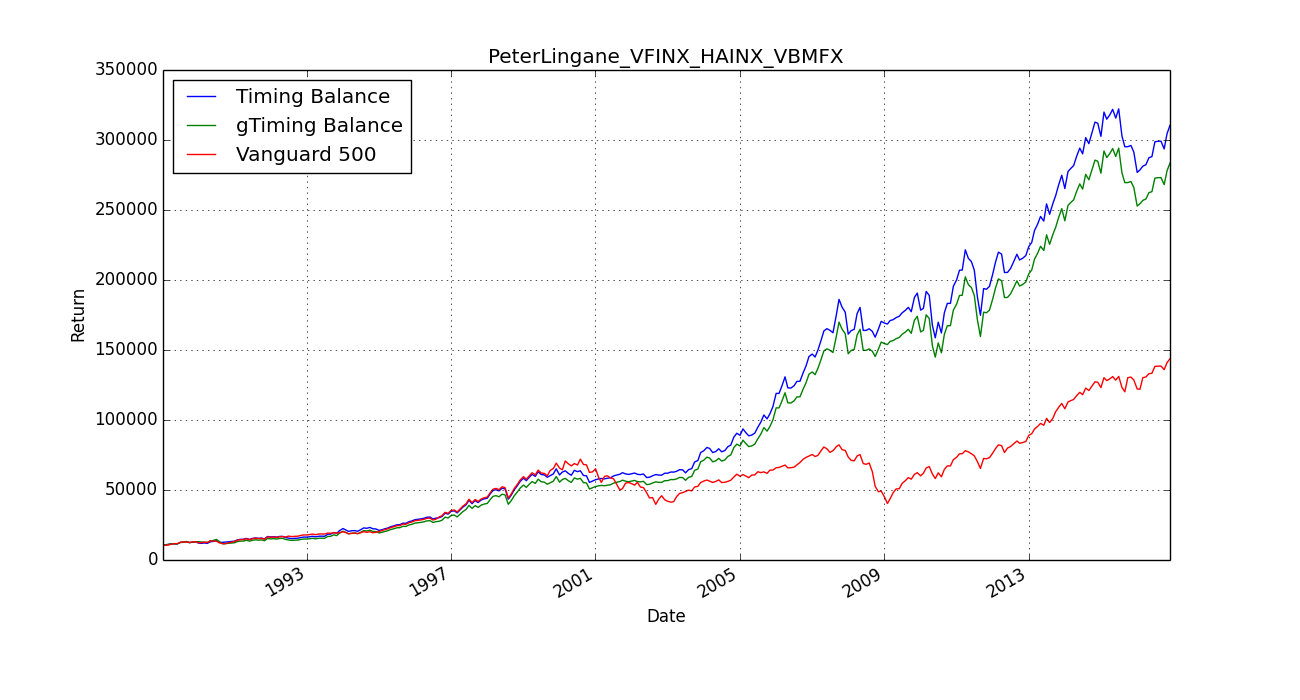

Peter (primarily) used:

o VFINX (Vanguard 500 Index Fund Investor Class) and

o HAINX (Harbor International Fund Institutional Class) and V

o VBMFX (Vanguard Total Bond Market Index Fund Investor Shares)

AlZmyslowski_VFINX_NAESX_FGOVX

PeterLingane_VFINX_HAINX_VBMFX